There is an adage that says: If you want to go fast, go alone, but if you want to go far, go together.

The importance of collaboration in business can’t be stressed enough, especially when it comes to fintechs working with banking institutions.

According to goals set out by the South African government and the South African Revenue Bank (SARB), collaboration is a key driver for increasing financial inclusion, giving access to financial services to those in society that don’t have access already. To date, fintechs and banks have set out to reach the goal of 90% inclusion on their own. But, to reach these goals, major players ultimately need to work together.

Open banking

One concept paving the way for this collaboration to take place is open banking. This allows interoperability between banks and third-party payment providers (TPPP). By giving these providers secure access to consumer banking information, TPPPs can better facilitate transactions between merchants and customers. It ultimately allows for a smoother, frictionless process that result in a securer payments experience.

The rise of open banking has greatly transformed the global payments space. In certain countries, customers can utilise smart credit cards with built in fingerprint scanners or even auto-cancel subscription services they no longer use.

What fintechs provide banks

An ideal partnership is based on trust and strength. It allows your partner to offer strength where you might be weak, and vice versa. For banks, a particular pain point is agility, or the ability to implement newer processes and technologies quickly. Another would be access to customers; TPPPs give banks a way to reach more users that opt to use TPPPs to transact with virtual shopfronts.

As consumer behaviour evolves alongside global technological trends, the need for more streamlined and agile services becomes greater. Research supports fintechs’ ability to fulfil this need: According to a report by Ernst & Young Global Limited (EY) the adoption rates of fintech solutions has increased to 64% in 2019 showing their ability to address the market’s demand.

Uptake of fintech products is further supported by a separate report conducted by McKinsey & Company, 71% of participants surveyed preferred to have multiple ways to transact when shopping online. They also found that 25% of consumers wanted a private, fully digital banking experience, with remote assistance when needed.

These findings show an inclination toward more agile, self-service options that are streamlined for efficiency. Essentially, what fintechs provide.

What banks provide fintechs

While banks might not be as agile as fintechs, they’re established brands with existing customers and massive networks which many fintechs could greatly benefit from. These networks boast a wide array of already established services that can provide fintechs with the ability to scale rapidly, while addressing the needs of customers the bank may be unable to reach.

Major banks also have the added benefit of a long-term understanding of their customers’ behaviours and trends. With collaboration, this potentially accelerates fintech’s ability to make smarter decisions at a much quicker speed, to capitalise on upward trends, while also being agile enough to act quicklyon downward trends as well.

For fintechs, banks biggest draw ultimately remains their sheer institutional weight. With an already established foundation, banks give fintechs a legitimacy needed to build their own reputation.

A stark truth

Tackling a new industry, – the world of TPPPs – can be challenging. According to findings by the US Bureau of Labor Statistics, only 55% of business survive within the first five years. Thereafter, only 35% make it past 10-years. One way to extend these times especially for a fintech is to partner or collaborate with the banking industry.

Collaboration remains a key component of not just success, but early business lifecycle survival. Finding synergy with the right partners not only establishes your company’s presence, but also gives you access to opportunities that would otherwise be out of reach.

Real world collaboration

Startup competitions and incubators have been a great source of collaboration between the two entities. For a long time, this was not just an ideal symbiotic bond between the two, but the only major point of collaboration. Now, thanks to open banking, the distance in that relationship has lessened, while gaining further importance.

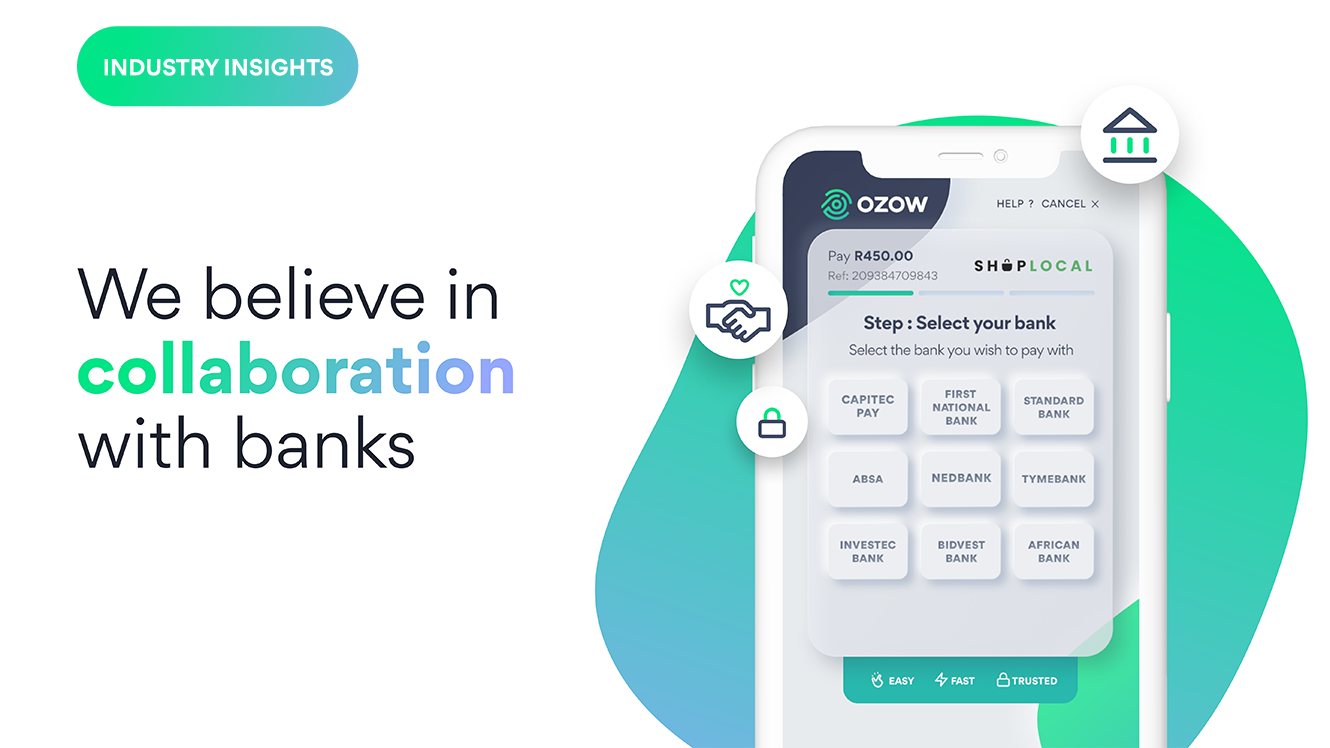

A perfect example of banking and fintech synergy can be found right here at Ozow. Our system integrates with all of South Africa’s major banks – most recently, we’ve collaborated with Capitec to implement Capitec Pay, SA’s first payments API.

Other examples of successful collaborations involved Commerzbank AG, a German bank and a company called IDnow. The dilemma which IDnow addressed was that due to EU laws, customers needed to go into a bank facility to verify their identification. IDnow provided them with a solution that allowed customers to verify themselves using a video submitted on their mobile device or PC. This collaboration resulted in a 50% conversion rate in customers downloading the app.

These collaborations show the power of working in unison whether it be Ozow and Capitec or IDnow and Commerzbank AG.

While this is just one way we’ve utilised collaboration with big banks, the future of the payments industry doesn’t lie in a singular partnership. It lies in the entire industry coming together to make financial inclusion for all a reality – not just a goal.

Citations

-

Staff Writer

.png)